iOS 11.2 and watchOS 4.2 are mostly bug-fix updates, but with one big new feature: the inclusion of Apple Pay Cash, an easy way to pay and request money from friends using your iPhone, iPad or Apple Watch.

You can keep the money you receive this way, spend it at retailers that accept Apple Pay or withdraw funds to your bank account. When you update to iOS 11.2, you will see the new Apple Pay Cash card in the Wallet app along with a companion iMessage app in Messages.

Subscribe to iDownloadBlog on YouTube

For those of you who have iOS 11.2 installed or are just curious, let’s take a look at the Apple Pay Cash setup process, how it works and what you can do with this feature.

Setting up Apple Pay Cash

Setting up Apple Pay Cash couldn’t be easier.

Head straight to the Wallet app or simply follow the prompt that appears inside of the Messages app. In Wallet, tap on the button labeled Setup Apple Pay Cash. Agree to the terms and conditions, verify your name and identity and you’re good to go.

Verifying your identity is important as this is essentially a bank account.

Using Apple Pay Cash

Apple Pay Cash lives as an iMessage app in Messages.

When someone requests money from you in Messages, the QuickType keyboard will prompt you to use Apple Pay. To request money, you open the iMessage app, type in the amount you are owed and hit the Request button. It’s important to note that both you and the receiver must have iOS 11.2 installed and Apple Pay Cash set up on their devices.

Additionally, iOS will create a link on any dollar amount it sees.

If you tap on that, it automatically launches the Apple Pay iMessage app and pre-populates the value with the amount requested.

Adding funds

You can also transfer funds into your Apple Pay Cash account using a credit or debit card.

If you use a debit card, the whole process is free. However, using a credit card will incur a three percent fee which is standard amongst peer-to-peer payment apps and services.

From the Wallet app, you can add funds to your card or withdraw them to your bank account. If your card is empty and you receive a money request, you’ll get a prompt to add funds, making the process seamless.

Apple Pay Cash on Apple Watch

Apple Pay also gets added to the Messages app on your Apple Watch. It works the same way as it does on your iPhone—you just tap Apple Pay, set the amount and double click the Side button to confirm.

Apple Pay Cash virtual card

Aside from sending and receiving money in Messages, you can also use the Apple Pay Cash card as a full-on virtual debit card. Any place that accepts Apple Pay (in-store or online) you can pay using funds in your Apple Pay Cash account.

The card appears in the Wallet app along with your other credit and debit cards.

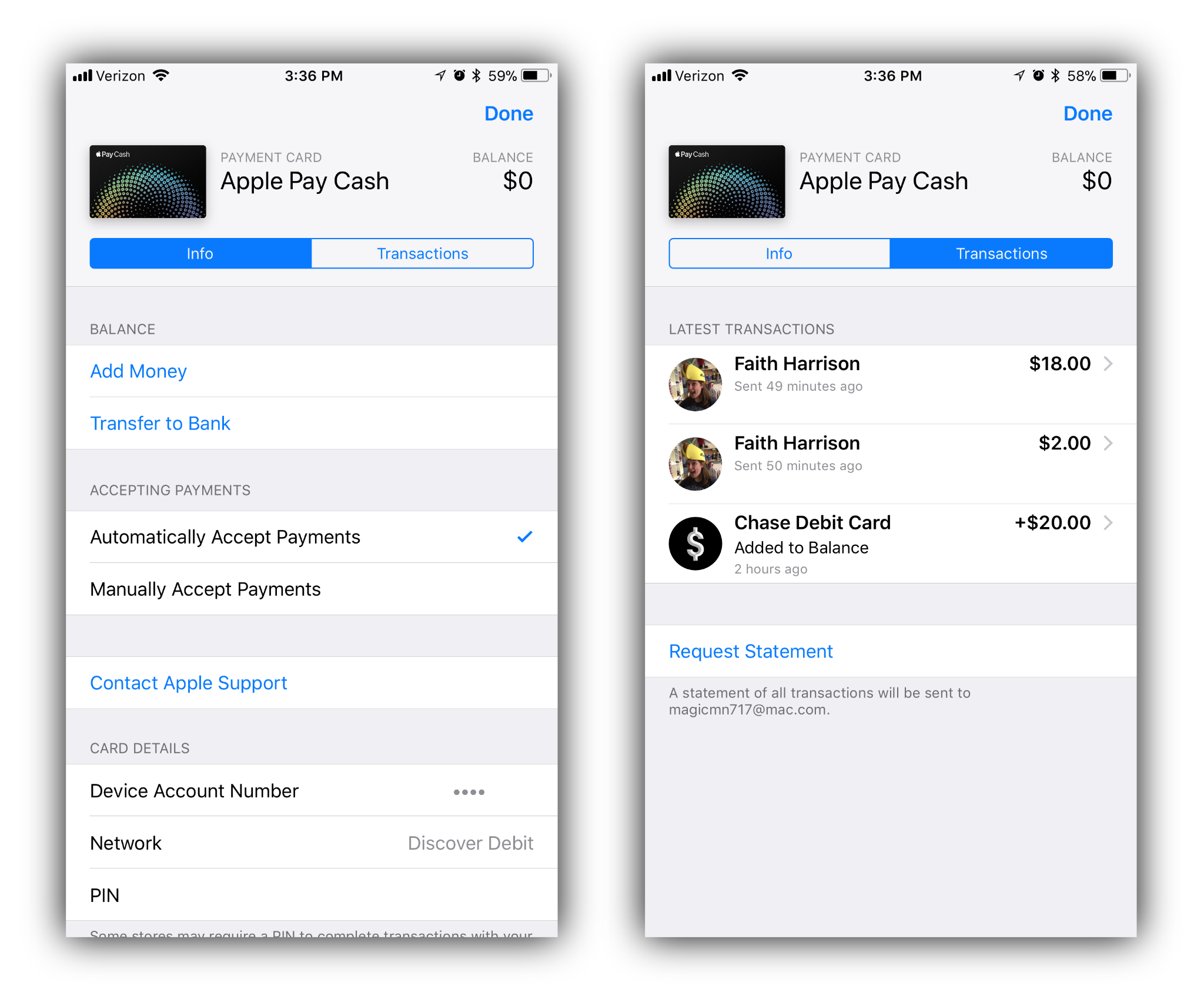

Tap the small “i” in the lower-right corner of the card to reveal a variety of settings and information. For instance you can add or withdraw funds, automatically or manually accept payments or view/edit card details like your PIN number and billing address.

You are also able to view all of your recent transactions, and request a statement.

It’s a wrap-up, boys and girls!

Apple Pay Cash is super easy to use.

However, it remains to be seen if Apple’s integrated solution and additional feature set are enough to displace the leaders in peer-to-peer payments like Venmo, PayPal and Square Cash.

Personally, I love the ability to keep everything within Apple’s walls.

Using the Cash card as an Apple Pay-equipped debit card is pretty fantastic, too.

No longer do I have to wait for funds to transfer if I don’t want to wait before using them. The system loses some of the fun social features prominent in Venmo, but time will tell if that is a unique enough aspect to keep Venmo on top.

What do you think about Apple Pay Cash? Is this enough to convert you from your app of choice? If you’ve already tried it out, tell us about your experience in the comments.