At a press conference Tuesday, the European Commission’s competition commissioner Margarethe Vestager announced that the European Union has ordered the government of Ireland to collect up to €13 billion, or about $14.5 billion, in back taxes from Apple. The sum represents Europe’s largest tax penalty and a significant increase over the 1 billion figure floated around ahead of the ruling.

Apple will appeal the decision.

“Ireland has been instructed by the European Commission to recover up to €13 billion of alleged state aid from the company covering a ten year period,” reads the ruling.

Ireland’s position remains that the full amount of tax was paid in this case and no state aid was provided. “Ireland did not give favorable tax treatment to Apple,” country officials noted. “Ireland does not do deals with taxpayers.”

“The European Commission has launched an effort to rewrite Apple’s history in Europe, ignore Ireland’s tax laws and upend the international tax system in the process,” wrote Apple’s boss Tim Cook in an open letter published on Apple’s Irish website.

Entitled “A Message to the Apple Community in Europe,” it lays out the company’s official position in this controversial case. “The opinion issued on August 30 alleges that Ireland gave Apple a special deal on our taxes. This claim has no basis in fact or in law,” the CEO wrote.

Cook is “confident” that the huge tax bill will be reversed.

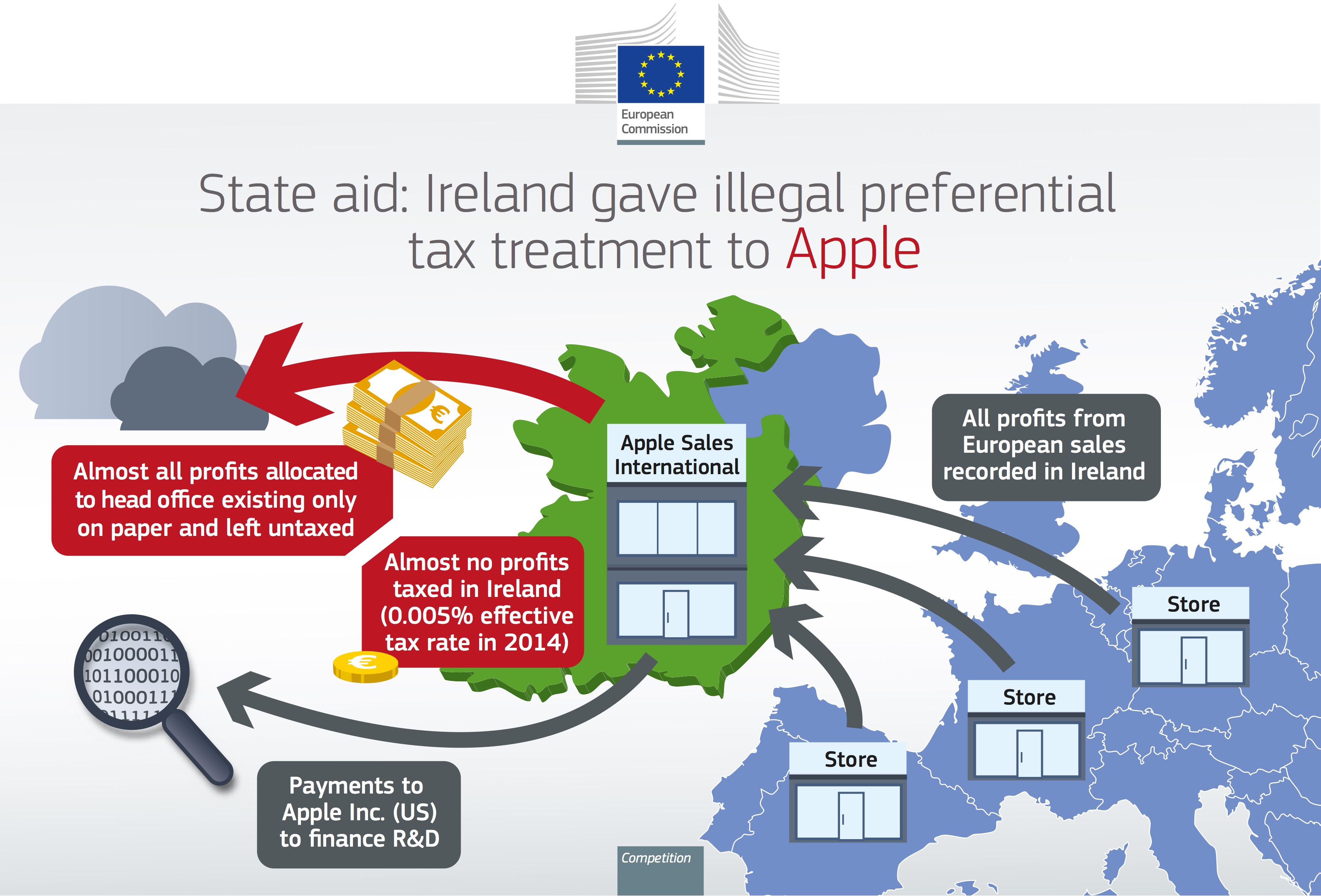

In what it called “illegal stated aid,” the Commission has determined that Ireland’s sweetheart tax deal with Apple basically gave the Cupertino company preferential tax treatment. “Member states cannot give tax benefits to selected companies—this is illegal under EU state aid rules,” Vestager said.

In some years, Apple’s deal with Ireland allowed it to pay a tax rate of as low as two percent on its global income, compared to 35 percent in the United States.

“The easy days of single-digit tax rates are going to be over,” University of Southern California law professor Edward Kleinbard said yesterday in an interview with CNBC’s “Closing Bell.”

The EU’s website provided infographic seen top of post which illustrates how Apple was able to unfairly reduce its tax bill in a way not available to other companies.

Apple’s so-called head office in Ireland had no employees and no premises, Vestager highlighted. “This was possible under Irish law, which until 2013 allowed for so-called stateless companies,” she said.

Apple, of course, begs to differ.

“Apple follows the law and pays all of the taxes we owe wherever we operate. We will appeal, and we are confident the decision will be overturned,” said the Cupertino firm in a statement released to media, adding this:

The European Commission has launched an effort to rewrite Apple’s history in Europe, ignore Ireland’s tax laws, and upend the international tax system in the process. The commission’s case is not about how much Apple pays in taxes—it’s about which government collects the money. It will have a profound and harmful effect on investment and job creation in Europe.

Ireland’s finance minister, Michael Noonan, said in a statement that the Commission’s decision “leaves me with no choice but to seek Cabinet approval to appeal the decision before the European courts.”

Though the ruling requires Ireland to recover the tax sums, the Commission is also acknowledging that the sums may in fact be taxable in other jurisdictions.

The amount of unpaid taxes to be recovered by the Irish authorities would be reduced if:

- Other countries were to require Apple to pay more taxes on the profits recorded by Apple Sales International and Apple Operations Europe for this period.

- US authorities were to require Apple to pay larger amounts of money to their US parent company for this period to finance research and development efforts.

Apple shares were down 1.6 percent in premarket trading following EU’s ruling.

Source: EU