Activist investor Carl Icahn today issued yet another open letter to Apple CEO Tim Cook. In it, he predictably pushes for an ever expanding increase of Apple’s share repurchase program.

More important than that, this time around Icahn is basing his valuation of the Cupertino firm in part on the prospect of the mythical Ultra HD Apple TV set and the Apple Car project, another sketchy rumor that had briefly entertained the press earlier in the year.

The feared investor is now valuing Apple at $1.4 trillion, expressing his belief that AAPL should be trading at more than $100 higher than its current valuation.

Bullish on the Apple Watch, the current state of the Apple ecosystem and the allure of a larger 12.9-inch iPad, Icahn projects Apple will grow its earnings by a respectable 40 percent this year.

“After reflecting upon Apple’s tremendous success, we now believe Apple shares are worth $240 today” versus the current share price of $130 per share.

The controversial investor has made a bold bet that Apple will enter two new product categories, the television next year and the automobile by 2020. Before you jump straight for the comments, note that the two markets have a combined market valuation of $2.2 trillion.

That’s three times the size of Apple’s existing markets, sans the Apple Watch. Market for new cars is valued at a cool $1.6 trillion, which works out to approximately four times the size of today’s smartphone market.

“We believe the rumors that Apple will introduce an Apple-branded car by 2020, and we believe it is no coincidence that many believe visibility on autonomous driving will gain material traction by then,” reads the letter.

People spend an estimated one hour or more every day traveling. With CarPlay, Apple has limited presence in the car.

That being said, an autonomous electrical vehicle of its own would permit the Cupertino firm to bring its “peerless track record of marrying superior industrial design with software and services, along with its globally admired brand, and offer consumers an overall automobile experience that not only changes the world but also adds a robust vertical to the Apple ecosystem.”

The electric battery should play a key role in this transition and some of Apple’s presumed battery life innovation for the rumored car project should trickle down to all the other products in the Apple ecosystem that should share the benefit from said battery innovation.

“As a mobile device that is differentiated by design, brand, and consumer experience where software and services are increasingly critical, an Apple car would seem to be uniquely positioned,” the investor summed up.

Icahn then moved on to make the case for the rumored Apple television set. For starters, the television enjoys an addressable market of approximately $575 billion, larger than the smartphone market.

“Given that people spend an average of twelve precent of the day watching TV (equating to 25 percent of their free time), we view television’s role in the living room as a strategically compelling bolt-on to the Apple ecosystem,” he wrote.

“A more dramatic push into the TV market” should entail a standalone Ultra High Definition (4K) television set, a “skinny bundle” of pay-tv channels and an updated Apple TV hardware, Icahn continued.

Multiple sources have previously reported that a refreshed Apple TV hardware is in tow for WWDC next month, with 9to5Mac’s Mark Gurman learning from sources that a “TVKit” for writing Apple TV apps will debut at WWDC next month. Gurman also called for a refreshed Apple TV console with Siri integration, a “fancy” new remote and other perks.

Finally, Icahn thinks Apple will maintain pricing and margins that are the envy of the industry, “despite significant evidence to the contrary.”

In addition to the rumored Apple Television and Apple Car projects, Icahn justifiably admires the strength of Apple’s ecosystem, which recently expanded its footprint with the introduction of new services like Apple Pay, HomeKit and HealthKit, and more to come including the rumored Beats Music revamp next month.

“Ongoing innovations and enhancements to all of the above will drive even more premium market share gains for iPhone, which sits at the epicenter of this mega-ecosystem,” reads the memo.

“If you choose not to pursue some of the new categories we highlighted, or you find our growth forecasts too aggressive for any one new category in particular, we’ll be the first to admit that you are more knowledgeable in these areas than we are,” Icahn summed it up nicely in the closing paragraph of his open letter to Apple CEO Tim Cook.

While it’s difficult to predict Apple’s next move, and if the company will enter any new product category for that matter, we can at least make educated guesses based on the money the company spends on research and development (R&D).

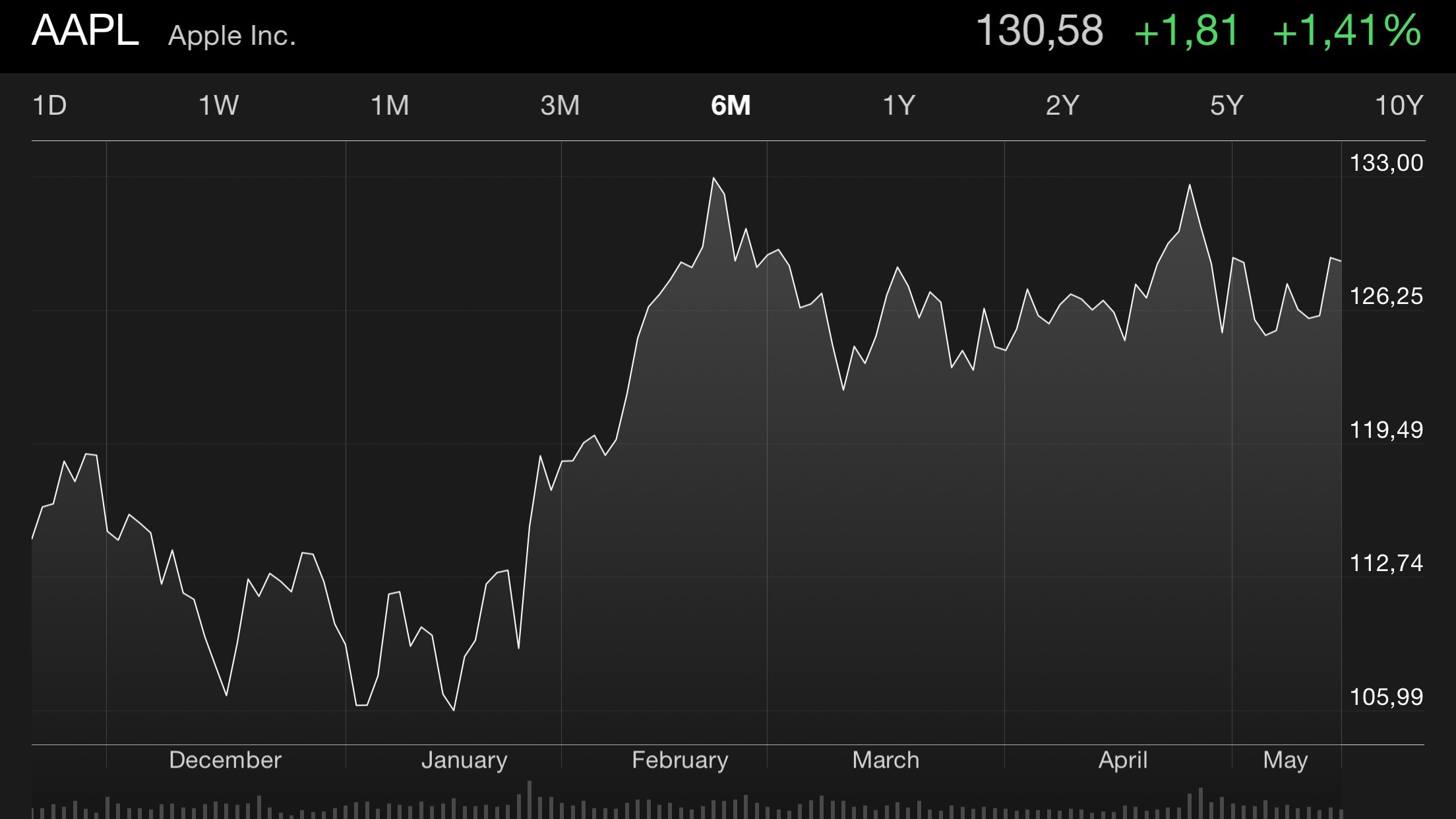

Below: Apple shares today.

Any significant ramping of R&D spending would likely point to a new product, or even a new product category, in the pipeline. Apple’s “dramatic increase in R&D spending should signal to investors that Apple plans to aggressively pursue these growth opportunities,” said Icahn.

To that extent, Apple did increase its R&D spending by thirty percent annually through its fiscal year 2017, to a whopping $13.5 billion. Not only that, but they’ve been quite busy for the past year or so opening new R&D centers in Israel, Japan, London, Boston and in other places.

By comparison, just five years ago the iPhone maker was spending only $1.8 billion on researching new products. For those wondering, research and development is an operating expense and does not count as capital expenditure.

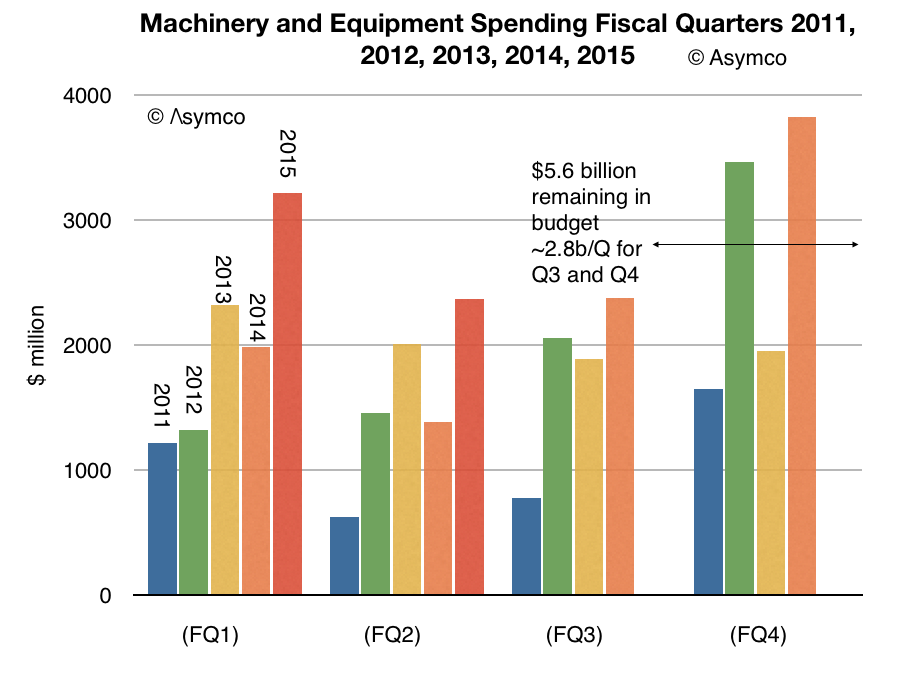

Based on the current projections for the next two quarters implying about $2.8 billion per quarter spending, Asymco analyst Horace Dediu forecast that Apple is likely to ship an astounding 120 million iOS devices between April and September of this year.

As for its capital return program, it’s worth reiterating that Tim Cook & Co. thus far have repurchased $80 billion of Apple’s shares. In addition, the Board of Directors has recently authorized an expansion of the initiative from the $90 billion level announced last year to $140 billion.

Most of the money for the capital return program comes from debt sale for it’d be very inefficient from a financial standpoint to repatriate Apple’s oversea cash at the current U.S. corporate tax rate of 35 percent in order to fund the share repurchase program.

Source: Carl Icahn