It’s a common practice now under fire from Germany’s finance chief: giving corporations tax breaks to locate and develop their patents – and hopefully hire local workers. In a Europe struggling with widespread economic troubles, the tactic known as the ‘patent box’ should stop, Germany asked a gathering of European Union finance ministers.

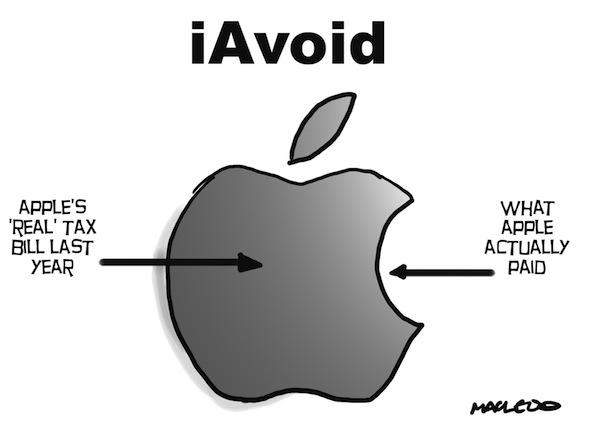

At the heart of the dispute between Germany and other European countries are reports Apple and others multinationals used local tax laws to save money…

“We have to look at this practice and discuss it in Europe,” German finance minister Wolfgang Schaeuble told reporters in Brussels, according to Reuters. “You could get the idea they are doing it just to attract companies,” the understated Schaeuble posited.

Mind you, the German minister can say “they” because his country is not among the EU nations that have adopted the “patent box.”

According to tax advisers Deloitte, Belgium, France, Hungary, the Netherlands and Spain are among the European countries offering the tax breaks, Reuters reports.

Belgium, which kicked-off the practice, apparently is mulling over restricting the option after the government there discovered the tax breaks were eating into revenue more than first believed.

The UK and other Europe nations (such as France) are also undergoing investigations into their own tax laws when it comes to corporate taxes.

How much do these tax breaks help companies?

Pharmaceutical giant GlaxoSmithkline could see its tax rate fall by three percent – to 21 percent – after the UK offered a deal in return for the company building a plant there. Online travel firm Priceline.com could see the tax rate for a unit in the Netherlands drop by four percent.

Instead of this patchwork of tax benefits, the EU’s European Commission seeks to create a Common Consolidate Corporate Tax Base that uses a complicated formula to spread profits among all countries.

Earlier this year, news that Apple had used a business unit in Ireland to funnel the majority of its profits caused an uproar not only in the US, but across Europe.

An Irish committee investigating that practice recently voted not to drag Apple and Google executives to testify before the lawmakers.