The battle between Apple and Samsung for smartphone supremacy rages on. While the two rivals accounted for more than half of smartphones sold during 2012, demand for the South Korean firm’s phones rose nearly 86 percent while iPhone sales rose by around 22 percent last year. According to Gartner, the two companies took No. 1 and No. 3 spots in overall while ranking first and second in the growing market for smartphones, respectively.

This as the cell phone industry saw its first dip in sales since 2009. Other vendors, of course, were left fighting each other for scraps…

The two competitors control 52 percent of smartphone sales, an increase from late 2012 when researchers noted that Apple and Samsung were almost at the 50 percent combined market share.

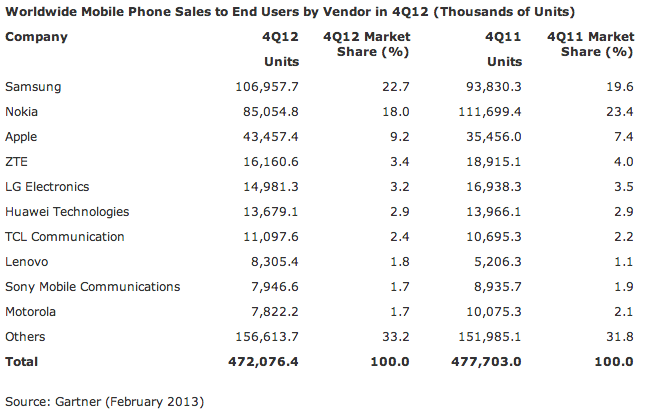

Gartner found that global mobile phone sales in 2012 dropped by 1.7 percent, compared to 2011, Samsung saw its share of the market during the fourth quarter increase to 22.7 percent, up from 19.6 percent a year ago.

Here’s a table representing Gartner’s estimates of global handset sales in Q4 2012.

The cell phone and smartphone maker had 22 percent for all of last year, a jump from 17.7 percent for 2011, according to the researcher.

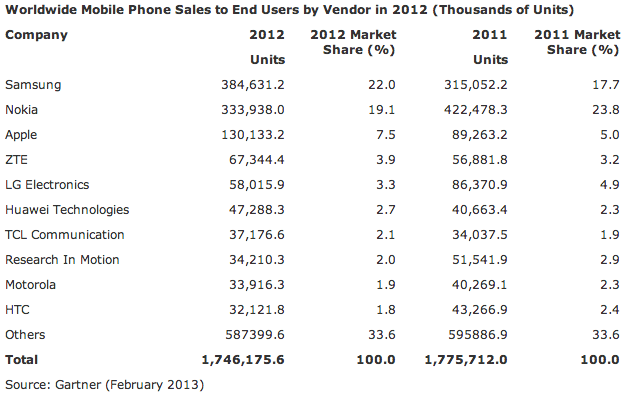

Meanwhile, Apple’s share of the entire mobile phone market rose to 9.2 percent during the fourth quarter, up from 7.4 percent during the same three-month period in 2011. For all of 2012, the iPhone maker had 7.5 percent of the market compared to 5 percent for 2011.

In phone sales, Samsung increases its #1 lead, Nokia stays #2 but drops, Apple rises in #3 & then its others far behind bit.ly/XL8YP3

— Danny Sullivan (@dannysullivan) February 13, 2013

Although Nokia saw its share of the global market fall to 19.1 percent during 2012, down from 23.8 percent in 2011, sales of its Asha and the Windows Phone 8-powered Lumia was enough to put in second place overall.

However, the future appears to be smartphones. Smartphone sales during the fourth quarter of 2012 rose 38.3 percent to 207.7 million handsets.

By comparison, demand for feature phones fell 19.3 for all of 2012, selling more than 264 million units for the year. For 2013, smartphones will comprise 1 billion of the 1.9 billion handsets purchased by consumers, Gartner forecasts.

Here are handset sale for the calendar year 2012.

While Samsung sells both feature phones and smartphones, the company is now seen as the face of Android devices.

Gartner research analyst Anshul Gupta weighs in:

With Samsung commanding over 42.5 percent of the Android market globally, and the next vendor at just six percent share, the Android brand is being overshadowed. The Galaxy name is nearly a synonym for Android phones in consumers’ mind share.

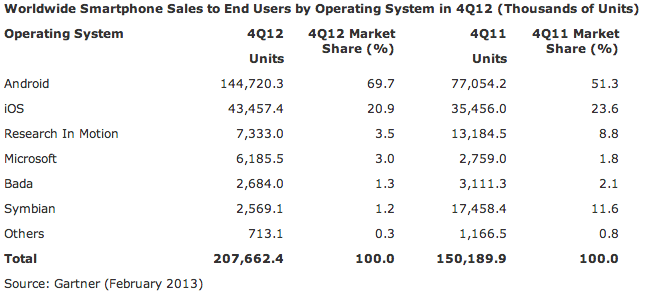

Android-based smartphones had 69.7 percent of the market during the fourth quarter, up from 51.3 percent during the same period in 2011.

This table depicts global smartphone OS share.

However, Apple’s iOS market share may have been hurt as consumers purchased inexpensive earlier iPhones or debated concerning upgrade paths.

While the demand for iPhones during the fourth quarter remained strong, consumers’ demand favored the less expensive iPhone 4 and 4S models. The iPad mini “also created a dilemma for some users when deciding to upgrade an iPhone 4 or iPhone 4S to an iPhone 5, or buy a new tablet.

Possibly as a result, the iOS market share in smartphone sales dropped to 20.9 percent during the fourth quarter, slipping from 23.6 percent during the 2011 fourth quarter.

Gartner ranked Huawei, China’s state-sponsored and fastest growing handset maker, as the No. 3 smartphone vendor.

During 2012, the company saw a 73.8 percent jump in smartphone sales, largely fueled by the firm’s Ascend D2 and Mate – two handsets announced during CES and hoping to attract consumers wanting a premium brand and a low cost.