Really, why should Apple make the iPad mini other than what Bloomberg, WSJ and NYT heard? Per conventional wisdom, Cupertino needs to move fast now Google’s Nexus 7 is picking up steam (the $249 16GB model is sold out). Some people reckon Apple must launch a smaller iPad in order to keep folks locked inside its ecosystem and away from Google’s.

Others reason the shrunken iPad that fits inside women’s purses could easily become a new fashion statement (and they’re probably right). And we can fairly safe assume that Santa would bring $199 mini iPads to lots of kids this Christmas (naughty ones will get a Kindle Fire).

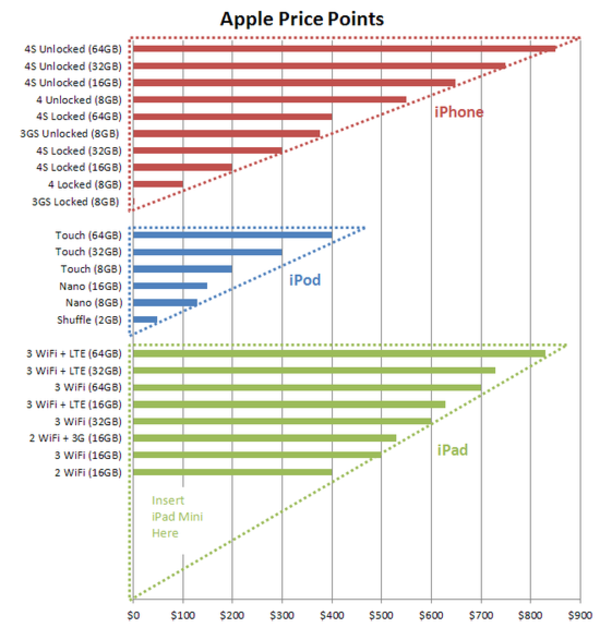

But as with all consumer electronics, including Apple’s shiny gadgets, the case for iPad mini boils down to sales projections, spreadsheets and charts. It just so happens that I’ve stumbled upon an awesome chart which illustrates unambiguously why the iPad mini is a missing link in Apple’s iOS portfolio…

Ryan Jones gets the credit for this surprisingly revealing chart of Apple’s price matrix.

Noticed the “insert iPad mini here” spot?

As you can see, Apple’s price umbrella for the iPod music player and the iPhone covers a wide gamut of prices, ranging from the $49 iPod shuffle and all the way up to the $399 64GB iPod touch.

In the case of the iPhone, $0 in most markets buys you an 8GB iPhone 3GS with an obligatory two-year service contract (prepaid iPhone 3GS just got re-priced below $200 unsubsidized). Prices go all the way up to $849 for an unlocked 64GB iPhone 4S.

And the iPad?

Well, the cheapest iPad the money can buy today is a $399 16GB WiFi iPad 2.

Everything bellow $399 is up for grabs and both Google and Amazon have happily exploited an opportunity that presented itself.

As additional $199 tablets from other vendors arrive – and arrive they will – it’s gonna be a lot harder to justify the $399/$499 asking price for an iPad.

Price advantage is still on Apple’s side on the nine or ten inch playground, but that doesn’t really matter anymore.

What matters is that suddenly $199 can buy you a sleek, very portable and very light tablet with a smooth user interface. It’s no iPad, but it’s no slouch either.

And as people get bombarded more and more with inexpensive slates, competitors will increasingly impose the notion that the iPad is overpriced.

In the mind of ordinary consumers, it won’t matter the slightest bit that the iPad is a high-end device that offers premium experience while Nexus 7 (and other Jelly Bean tablets that’ll follow) rocks screens between seven and eight inches diagonally.

A lot of people just won’t care.

$199 is the sweet spot.

Hence, Apple must have an iPad with which to cover the low-end of the market. And even if they brought the 9.7-inch iPad down to $199, seven inchers would still have the upper hand in terms of portability, lightness and thinness (and here’s a shocker: people care about their mobile devices being mobile).

Otherwise, cheap tablets will start eating into Apple’s sales and begin to steal the iPad’s market share.

The author of the above chart assessed as much in a blog post:

On a past Apple conference call, Tim Cook said “one thing we’ll make sure is that we don’t leave a price umbrella for people”. What’s that? A price umbrella is when a company with dominant market share maintains high prices, leaving an opening for new competitors to enter at lower price points.

In the case of the iPad, the price umbrella until recently was at $499. Someone could enter that market at lower prices and exhibit classic disruption to push them out from the bottom up.

So, if anyone can make an affordable iPad that doesn’t suck (or is better than Nexus 7) and still profit in the process, it’s gotta be Apple.

Makes sense, no?