Today’s first-quarter earnings from Verizon include 3.2 million iPhone activations. That’s down 1.1 million units, or 24 percent, from the 4.3 million iPhones they activated in the holiday quarter, when Apple sold a whopping 37 million iPhones.

Still, iPhones continue to make up over half of Verizon’s smartphone sales, easily beating the 2.1 million 4G LTE smartphones the carrier shipped.

Now, finance boss Fran Shammo hinted during a conference call with investors that Verizon could reconsider the iPhone subsidy and said they are “fully supportive” of Microsoft because the industry needs a third mobile platform.

It was enough for naysayers to come out of the woodwork and spell doom for the iPhone, the Apple stock and the company itself. You too must have seen sensationalist headlines lately that disseminate an anti-Apple sentiment.

So… Should Apple really be worried? And what the heck is up with Apple doomsayers and their crazypants analyst peers?

Here are my two cents…

First, have a look at what Shammo told investors on the call:

On the Apple iPhone, we look at every individual handset. We have a broad portfolio. We manage it handset by handset and manage our subsidy. This is just one aspect of our P&L and this is just a nature of this business. I do think though it is important that there is a third ecosystem that is brought into the mix here, and we are fully supportive of that with Microsoft. We created the Android platform from beginning and it is an incredible platform today that we helped to create, and we are looking to do the same thing with a third ecosystem.

His subsidy comment aligns nicely with BTIG Research’s Walter Piecyk who caused a stir warning recently how carriers think Apple is becoming too powerful. The analyst wrote in a note to clients that major carriers in the United States and elsewhere are mulling cutting or eliminating altogether Apple’s industry-leading iPhone subsidy.

Why?

Apple requires carriers to commit to huge iPhone orders worth billions of dollars, paid upfront, which hurts their bottom line.

Piecyk downgraded shares of Apple last week and you probably noticed shares took a dive over the past week, having fallen from an all-time high of $644 to under $600.

This too is contributed to subsidy concerns and worries that sales of Apple’s handset are beginning to decline.

Three things…

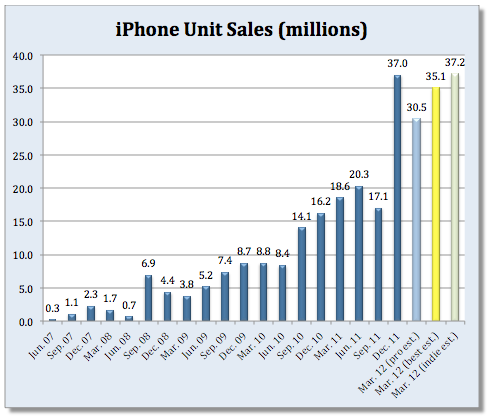

Firstly, of course iPhone sales are now dropping quarter-over-quarter and especially compared to the lucrative three-month holiday quarter which saw Apple push an astounding 37 million units, enough to become the world’s top smartphone maker.

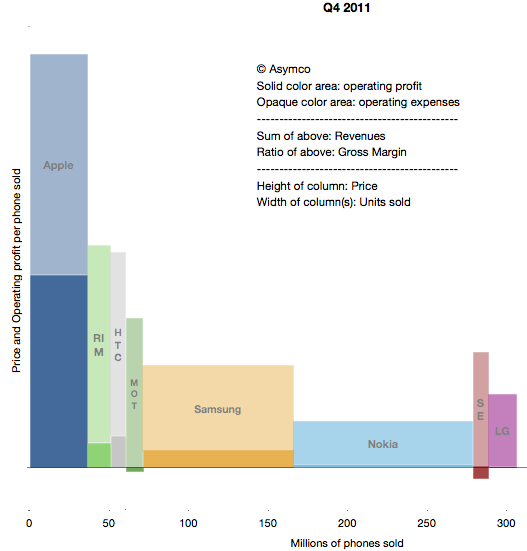

Apple only keeps a single smartphone family on the market – the iPhone. Compare this to other manufacturers that flood the market with countless models, most having a very short shelf life. Matter of fact, it’s this strategy that has spread Apple’s rivals thin so no wonder this year players such as Motorola, HTC and others are scaling back and rationalizing their smartphone portfolios.

Secondly, iPhones are more prone to seasonality than other smartphones.

Usually, the current model peaks during launch and holiday quarters. It’s therefore unreasonable to expect that a three-month period worth of sales ending March 31 could beat pent-up demand during Apple’s record-smashing holiday quarter.

It’s not unique to Apple, other phone vendors suffer from holiday seasonality, too.

Chart courtesy of Fortune

Thirdly, iPhone sales have traditionally cooled off as folks put off their planned purchases ahead of a next-generation model. That’s the nature of the consumer electronics business and it’s especially evident with smartphones.

We saw this play out with the iPhone 3G/3GS launches.

History is bound to repeat itself so expect iPhone sales to fall off the cliff either in the June or September quarter, depending on whether a sixth-generation iPhone launches in the summer or Fall.

And despite what some pundits are saying, there’s no reason to get worked up just because Apple won’t beat holiday-quarter iPhone sales when they post quarterly earnings next Tuesday.

And don’t get me started on Apple shares dropping just because some analyst assumed out of thin air that carriers will go bonkers and kill subsidies on their best-selling device.

Even if some carriers pull this, this will create a not-to-be-missed competitive opportunity for their iPhone-subsidizing rivals. It would be a different matter if these guys reached a consensus on eliminating the iPhone subsidy at the industry level, but it’s not going to happen.

This is hardly a new thing, mind you – carriers have been threatening to cut the iPhone subsidy since the dawn of time.

Matter of fact Jean-Louis Gassée covered this subject in excruciating detail in a great piece from more than a year ago.

The crux:

Carriers subsidize smartphones because it’s what their customers want, and they put up with the iPhone’s higher price because it’s what their customers want most. Just last week, a T-Mobile exec called for an end to smartphone subsidies — but refused to go first. When/if the iPhone becomes less desired, the carrier subsidies will subside.

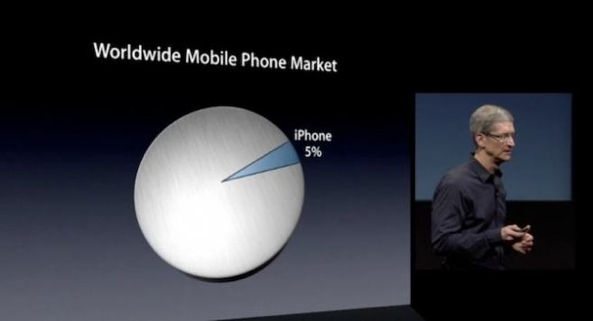

As for Apple not becoming a trillion dollar company just because shares lost some of their value lately, let’s focus on the big picture. The iPhone still accounts for only five percent of the worldwide market for handsets. Apple is well poised to grow iPhone sales as more and more feature and dumb phones become smartphones.

Here, a quote from Tim Cook’s keynote during last October’s iPhone 4S presser:

I could have shown you a much larger number if I just showed you smartphones. But that’s not how we look at it. We look at the entire market of handsets because we believe over time that all handsets become smartphones. This market is one and a half billion units annually. It’s an enormous opportunity for Apple.

Cook nailed it: smartphones taking over is an epic opportunity for Apple.

Apple pundit John Gruber summed it up nicely over at his Daring Fireball blog.

What’s remarkable about Apple’s revenue and profit growth is that it’s happened with product categories — phones and computers — in which Apple still has single-digit market share. It’s more useful to look at the iPad’s share of portable computers than its share of the “tablet” market, and it’s more useful to look at the iPhone’s share of the mobile phone market than the “smartphone” market.

All phones will soon be what we now call smartphones; and it may well be that most portable computers will soon be what we now call tablets.

And on Apple’s ability to retain industry-leading margins despite using (mostly) off-the-shelf components in gadgets, Asmyco’s Horace Dediu says it’s the software, stupid:

It comes down to software. Apple has a monopoly on iOS and OS X and charges for it through its hardware. That’s a very valuable monopoly. It’s worth at least $1 billion per quarter.

It’s really simple: Apple doesn’t make commodity products, folks recognize this and are willing to pay a premium for it.

But what if rivals somehow figure out Apple’s business model and costs and then build a cheaper phone that’s at least as good as the iPhone, as Karl Denninger suggested, writing for Seeking Alpha?

Could this bring Apple to its knees?

Back to Gruber, who opines in another post:

I agree with one thing: sustaining high profit margins is difficult. But where Denninger goes wrong is in assuming that competitors can easily or quickly copy what Apple is doing. His argument is no different than the dire predictions for the iPod a decade ago. Yes, Apple’s hardware margins are extraordinary. But Apple is an extraordinary company.

They have an unparalleled retail presence, a top-shelf brand, and a loyal, large, and growing customer base. They write and design their own entire software stack, have incredible third-party developer support, and, by selling very large quantities of a relatively small number of hardware products, attain astounding economies of scale.

I’m not saying Apple’s continued success is assured. But there’s no sense in an argument based on the supposition that Apple is in any way a typical hardware maker.

With that in mind, here’s to the hoping those crazypants analysts and click-hungry media outlets will alter their rhetoric because prophetizing the fall of Apple gets old fast, even more so when there’s no hard evidence to back up sensationalist headlines.

Feel free to vent your frustrations down in the comments.