Yesterday’s news that Apple’s contract manufacturer Foxconn bought an eleven percent stake in the Japanese multinational corporation Sharp sent the tongues wagging. With a 46.5 percent stake in Sharp’s LCD plant in Sakai, Osaka, conventional wisdom has it that Foxonn, which just released its 2011 financial report, will bolster Sharp’s LCD business and make it more profitable by securing the lowest prices on components.

Other folks think the two partners joined forces to battle LG Display and Samsung for orders of Retina displays for the new iPad. After all, Sharp is already been credited with small-volume shipments of 2,048-by-1,536 pixel resolution panels for the device and they’re about to ramp up production in the second quarter.

Another intriguing possibility includes next-generation flat panels for a rumored Apple-branded television set, nicknamed the iTV…

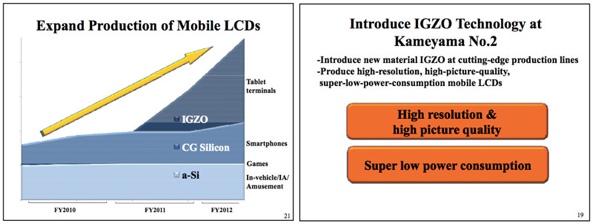

The 99-year old Sharp is losing big money with its LCD business, just as other HDTV makers aren’t doing particularly well either. That said, it make sense to partner with Foxconn and boost biz metrics. Sharp’s been rumored with attempting to sell Apple on its Indium Gallium Zinc Oxide (IGZO) display technology for the new iPad, but Apple passed on the technology to opt for traditional LCD screens.

Sony, which also owns a seven percent stake in Sharp’s Sakai plant, confirmed today with a press release it will make no further investment in Sharp Display Products Corporation (SDP), a joint venture to produce and sell large-sized LCD panels and modules. The Abeno-ku, Osaka-headquartered Sharp transferred its Sakai LCD plant to SDP in 2009. Later that year ,Sony acquired a 7.04 percent stake in the joint venture.

The amended agreement gives Sony the right to sell its share in SDP should Sharp partner with a third-party, as they’ve just done now with Foxconn. The PlayStation maker will decide what to do with its stake in the joint venture in September.

Sony’s likely exit indicates plans for high-volume production of IGZO flat panels for the iTV. Right this moment, Sharp’s 8G lines can produce LCD panels up to 55 inches, but IGZO panels are not ready for mass production on Apple’s scale, according to SlashGear.

IGZO technology could also allow for a thinner iPad with greater battery life because Sharp’s IGZO panels can hit a pixel density of 330ppi and do not require dual LED bars to illuminate the pixels. The new iPad has twice the LEDs for backlighting which contributes the most to a faster battery drain, among other reasons.

In addition, IGZO technology allows for wide viewing angles, negating the need for a premium (and pricey) display technology called In-Plane Switching. And with near-OLED power consumption, significant manufacturing cost savings and only 25 percent thicker than the increasingly popular OLEDs – no wonder Apple set its sights on IGZO tech.

Image courtesy of AppleInsider

It’s interesting that LG, Samsung and Sharp – all tipped as iPad panel suppliers – also sell Smart TVs so you may wonder why provide Apple with crucial display tech for a competing TV set? This isn’t an easy one to answer, but let it be observed that Sharp is the only party here forming a global strategic partnership with Foxconn, which assembles iPhones, iPads and MacBooks for Apple.

Make no mistake, Foxconn is pouring in big bucks in Sharp’s struggling LCD biz.

They are investing a combined 133 billion yen, or approximately, $1.6 billion in Sharp. Companies just don’t make commitments this large without an agenda of sorts. Conspicuously enough, Foxconn committed itself to buying up to half of all of Sharp’s LCD panel output.

According to DigiTimes:

Sharp indicated that Foxconn will procure panels and related modules from Sharp’s 10G plant in Sakai, Japan. The procurement will keep the 10G plant at high capacity utilization.

The hit-and-miss publication also quoted industry sources as saying that “Apple may want to use Sharp’s technology to produce Indium Gallium Zinc Oxide (IGZO) panels for Apple TVs”.

Foxconn is no stranger to large investments aimed at protecting and strengthening their lucrative Apple contract. For example, The company is believed to had purchased about a thousand expensive Fanuc CNC machines to make Unibody MacBooks.

That being said, I think it’s safe to ask oneself why the heck buy Sharp shares and invest in its floundering LCD business unless there’s a big order from Apple looming on the horizon?

I’m not alone in making these assumptions.

IHS iSuppli noted Sharp may begin mass production of Retina displays for the new iPad next month. Bloomberg quoted an analyst opining that “This is a risky and aggressive move by Foxconn, which is betting on current and future Apple products, including the iPad and an Apple television, a product which doesn’t even exist”.

TechCrunch discussed the possibility of large IGZO panels for the iTV. Let’s not forget that the credible Wall Street Journal claimed last August Apple would invest more than a billion dollars in a Sharp LCD plant, though this never came to be.

What’s your take? Am I scatter-shooting here or is there more to this deal than meets the eye?

As always, meet us in comments.